https://fred.stlouisfed.org/series/T10Y2Y

Yes, I’m sorry. This is a graph. Not a cool online game. Not a handy service. Just a simple graph offered by the Federal Reserve Bank of St. Louis… but it’s not just any graph. The 10 Year / 2 Year Spread, more formally known as the 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity, is considered to be a leading indicator of recession.

In the world of economics, an indicator is a quantifiable trend that correlates with an economic event like a recession. An indicator can be leading, lagging, or coincident depending on its tendency to predict, follow, or mirror the timing of the economic event.

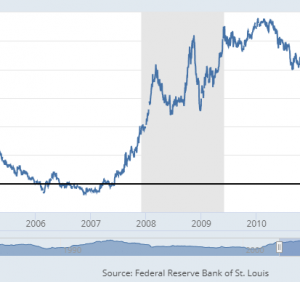

Now back to the 10 Year / 2 Year Spread. It doesn’t take a degree in economics to notice that almost every major recession in the past few decades has been preceded by peculiar pattern in the graph. The curve seems to trend downward, dabble in the negative, and then spike upward as a recession looms.

In a thriving economy, longer term bonds need a higher yield to encourage investors to lock down their funds for an extended period of time. Thus, 10-year bond yields are expected to be higher than shorter term bonds and the 10 Year / 2 Year Spread is positive. In a shrinking economy, however, the opposite occurs. As faith in the future of the economy waivers, more people flock to longer term bonds to secure their funds. The demand drives longer term bond yield down and inverts the curve.

For all the skeptics out there, I understand you. I’m a skeptic too. The most recent recession occurred in 2008. The curve dipped down to the negative around 2006. When I first encountered this graph I thought to myself I wonder what people were saying back in 2006.

The general consensus at the time was that the yield curve does not necessarily imply a recession is around the corner. Unfortunately in this case, they were wrong. The headline of this Reuter’s article from 2008 just about sums it up: As US recession looms, yield curve looks prescient.

Well it’s going down. As of the time of this writing, the spread is slowly dwindling downward. While this may not guarantee a recession is around the corner, it does mean that investors are beginning to lose faith in economy.